Rachel’s Journal Roundup Q3 2022

- Theine,H.; Humer, S.; Moser, M.; Schnetzer, M. 2022. “Emissions inequality: Disparities in income, expenditure, and the carbon footprint in Austria,” Ecological Economics (197).

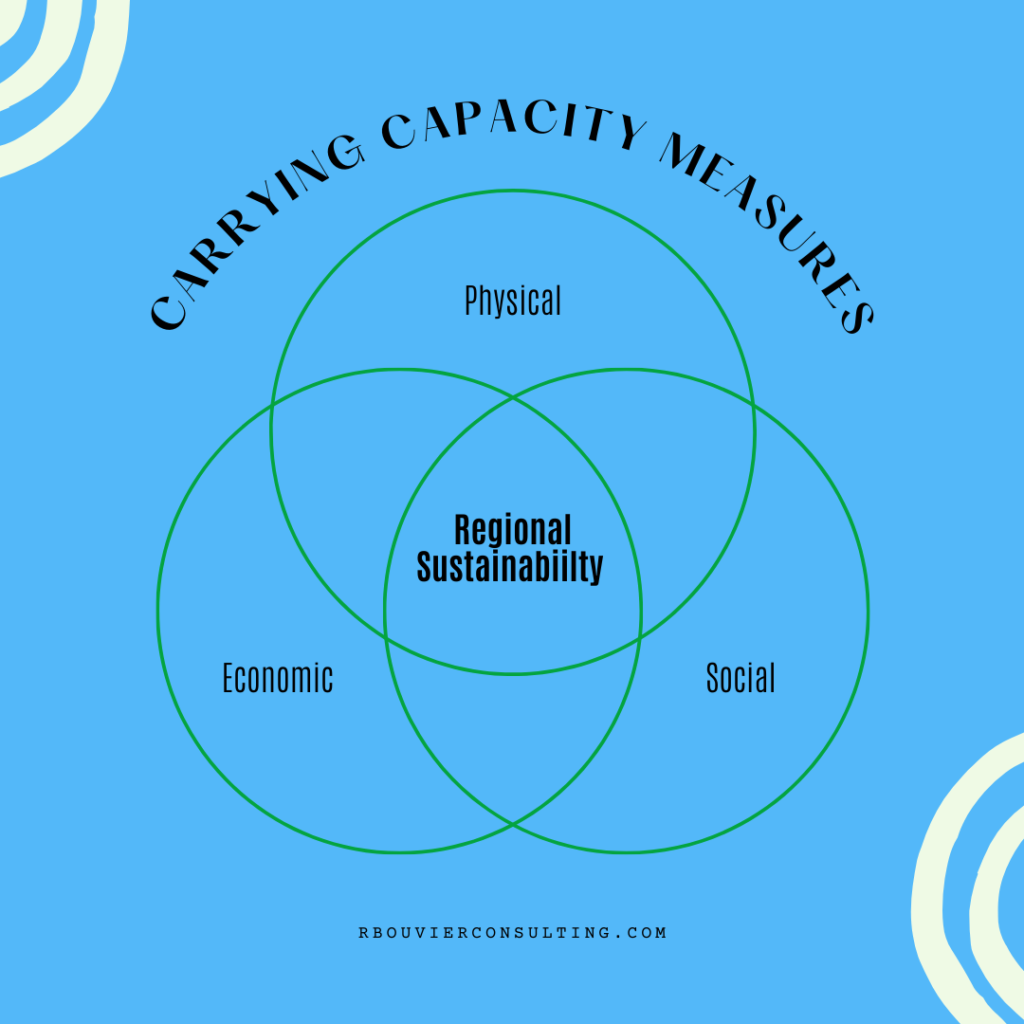

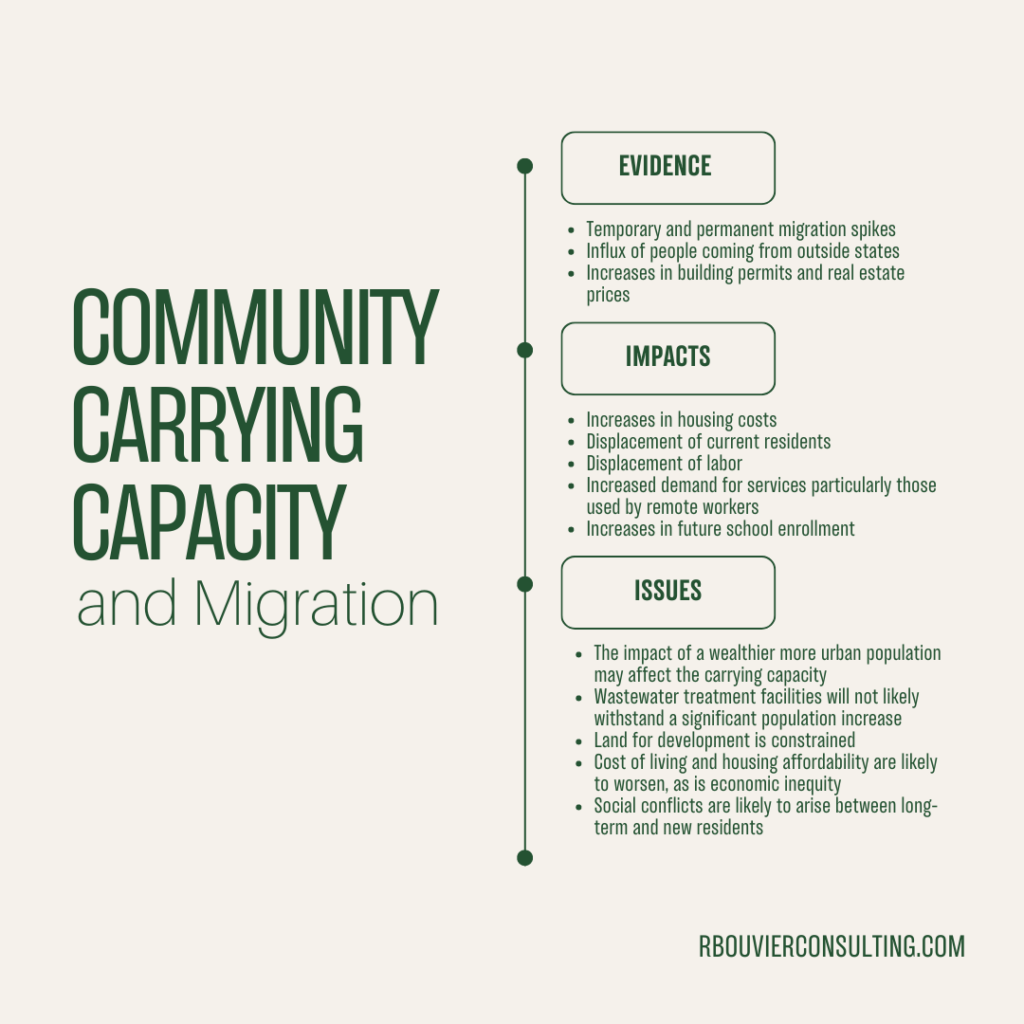

Recently, we completed a project for the Blue Hill Heritage Trust, where we estimated the economic, social, and environmental carrying capacity of the peninsula. One of the issues we considered was the environmental impact of those moving to the area. Like many areas in Maine, the Blue Hill region is seeing an influx of wealthier individuals to the area, primarily due to the rise of remote work. One question that was brought up for us is how households’ environmental impact changed with higher income levels. This article investigates the carbon content of households’ expenditure patterns. They find that the top decile of the income distribution in Austria receives 22% of national income, spends 18% of national expenditure, and causes 17% of emissions. The bottom decile, by contrast, accounts for just 3% of national income, 4% of expenditure, and 4% of emissions. While the article focuses on Austria, results are suggestive for the United States, where income inequality is much larger than it is in Austria.

While differences in income may explain some of the differences in emissions, they only explain about one third of the difference, implying that the remaining two-thirds of the variation in emissions is attributed to other factors. Not surprisingly, results show that characteristics such as housing stock, heating fuel, and car dependence all contribute to the variation in household carbon emissions.

These results are not surprising. However, they do bring up a question about the environmental footprint of households moving to Maine (and other places). If, as evidence seems to indicate, higher income people are moving to Maine, it may presage an increase in carbon emissions, based upon these results. However, the potential good news is that two-thirds of the variation in emissions was due to other factors. If newcomers to Maine reduce their dependence on fossil fuels either by weatherizing or upgrading existing housing stock, they may be able to mitigate some of the increase in emissions coming from increased consumption. If public transportation can be improved in areas that are attracting in-migrants, so much the better. It is possible that an influx of in-migrants will increase carbon emissions. But it is not inevitable.

- Kovacs, K.; West, G.; Nowak, D.; Haight, R. 2022. “Tree cover and property values in the United States: A national meta-analysis.,” Ecological Economics (197).

This article explores the relationship between tree coverage and property values. The authors refer to tree coverage as a public good because increased tree coverage in a given area of a neighborhood has been shown to increase value of the homes throughout the entire neighborhood. A representation of this relationship would help municipalities quantify the benefits of community forestry programs.

The hedonic property value method is a statistical technique that can be used to assess the value of ecosystem services to property. However, these studies are expensive and time-consuming, and oftentimes, local governments are unable to access the resources needed to carry out these analyses. The authors used hedonic property studies conducted in the past to create a benefit transfer tool (whereby multiple hedonic analyses are combined in a meta-analysis) that can be used to measure the value of tree coverage in communities that have not yet conducted hedonic property value analyses.

Results indicate that where existing tree cover is low, increasing on-property tree density increases property values, while increases in off-property tree cover has no statistically significant effect. In contrast, where tree cover is medium to high,, off -property tree cover has a greater positive effect on property valves than on-property tree cover. This perhaps reflects the belief that high density tree cover on the property is seen as increasing maintenance costs.

Although the study finds relatively low property value effects, increases in property values are only a small part of the benefits of increased tree cover. The ecosystem services provided by tree cover include air filtration, soil stabilization, flood control, recreation, and habitat provision, as well as aesthetic value. The authors conclude by noting that hedonic property studies can also be used to support open space zoning and green space ordinances.

- Mueller, J. 2022. “Natural Resource Dependence and Rural American Economic Prosperity From 2000 to 2015,” Economic Development Quarterly 36(3):160–176.

This article investigates the role that natural resources play in the economic development of US counties. There are two types of natural resource development: extractive natural resource use, such as oil and gas, mining, and timber, and non-extractive, such as tourism, recreation, and real estate. The author points out that dependence on natural resource development has been shown to be associated with decreases in per capita income, increases in inequality, and elevated poverty in the long term (the so-called “resource curse”). Yet not as much attention has been paid in the literature to the dependence on non-extractive natural resource development. This study aims to correct that, by studying both forms of resource development on economic outcomes in rural counties across the United States. The author makes a distinction between remote rural counties and metro-adjacent rural counties.

The author finds that the relationship between natural resource development and economic prosperity varies between non-metropolitan remote and nonmetropolitan metro-adjacent counties. Generally speaking, high levels of dependence on either extractive or non-extractive resource development was associated with negative economic outcomes for both remote and metro-adjacent rural counties. However, these relationships were complex. Non-extractive resource development in particular has been promoted in some strands of the literature to have a positive effect on economic outcomes in rural areas. But this work casts doubt on that hypothesis, indicating that non-extractive resource development may actually have a negative effect on the economic outcomes of remote rural counties, perhaps due to the low wages in many of those industries. More work needs to be done in this area.